A Nebraska Energy Source Exempt Sale Certificate Form 13E must be filed by every person claiming a sales and use tax exemption when it has been determined that more than 50 percent of the purchase of electricity, coal, gas, fuel, oil, diesel fuel, tractor fuel, coke, nuclear fuel, butane, propane, or compressed natural gas is used or directly consumed in manufacturing and processing, irrigation, farming, refining, or generation of electricity.

The Nebraska Resale or Exempt Sale Certificate Form 13 can only be issued by person(s) or organization(s) exempt from payment of the Nebraska sales tax by qualifying for one of the six enumerated Categories of Exemption listed on Form 13. Nonprofit organizations that have a 501(c) designation and are exempt from federal and state income tax are not automatically exempt from sales tax.

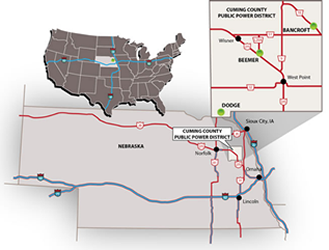

Dear CCPPD Customer,

If your electric account with CCPPD uses 50% or more electricity toward any of the qualified exemptions listed in Section A on the attached form, it could qualify as tax exempt. Please review the attached form, complete and sign if this account is to be tax exempt, and return to CCPPD, PO Box 256, West Point, NE 68788, drop it off in our office at 500 S. Main Street, West Point, NE 68788, or fill it out onilne by opening it in Adobe.

If you determine your account qualifies for tax exemption, it is necessary to fill out the form in its entirety. Your account(s) will NOT be marked as sales tax exempt until we receive the completed and signed form. If the form is not completed in full and correctly, the account will remain as taxable until the form is completed properly. If you have multiple accounts, each account needs a sales tax form completed, signed and returned to CCPPD.

A PROPERLY COMPLETED CERTIFICATE INCLUDES THE FOLLOWING:

A purchaser must properly complete a certificate before issuing it to a seller. To properly complete the certificate, the purchases must: (1) identify both purchaser and seller; (2) mark the box for either the “single purchase” or blanket” indicating whether the certificate is for a single purchase or is a blanket certificate for future purchases; (3) mark the appropriate exemption block indicating the category of exemption; (4) have the certificate signed by an authorized person; and (5) indicate the date the certificate was issued.

In the “describe your business operations” section, the answer to this question must be specific and complete. Farming alone is not a suitable answer. Please be as specific as you can. Examples include irrigation well, grain drying, hog barns, etc. Please be sure to check the appropriate options you qualify for, sign, and date the form.

If this account does not qualify for tax exemption, please contact us by phone to let us know. It is important for documentation purposes.

These regulations are enforced by the Nebraska Department of Revenue. In order for CCPPD and the customer to remain in compliance, these directions must be followed accurately. Please feel free to contact us with any questions you might have at the phone numbers listed above.

Thank you for your cooperation.

- Form 13E – Farming, Manufacturing, Processing: Fill-In

- Form 13 – Churches, Schools, Government, Villages: Fill-In

If you have any questions, please call CCPPD at 402-372-2463 or the Department of Revenue at 1-800-742-7474.

500 S. Main Street

500 S. Main Street